Presentation for credit investors

Credit notes

Fitch Ratings

In early 2019, Tikehau Capital obtained its first financial rating from the financial rating agency Fitch Ratings. With a stable outlook, this investment grade ratingGrade (BBB-) confirms the strength of Tikehau Capital's financial profile.

On July 26, 2023, Fitch Ratings confirmed Tikehau Capital's long-term rating at BBB- with a stable outlook.

In its press release, Fitch Ratings underlines the strength of Tikehau Capital's balance sheet and business model, which will enable it to pursue its strategy. In a sluggish market environment, the agency noted the Group's ability to maintain financial ratios compatible with an Investment Grade profile.

S&P Global Ratings

On March 21, 2022, Tikehau Capital was awarded a second financial rating by S&P Global Ratings. With a stable outlook, this Investment Grade (BBB-) rating confirms the strength of Tikehau Capital's financial profile.

On June 26, 2023, S&P Global Rating confirmed the company's Investment Grade profile (BBB-) with a stable outlook.

In its statement, S&P Global Ratings positively emphasizes the company's ability to use its own balance sheet to develop new strategies and new generations of funds, while continuing to align its interests with those of its investors. S&P Global Ratings reiterates its confidence in the Group's ability to maintain and grow its business in a volatile environment.

Credit lines

Syndicated Revolving Loan

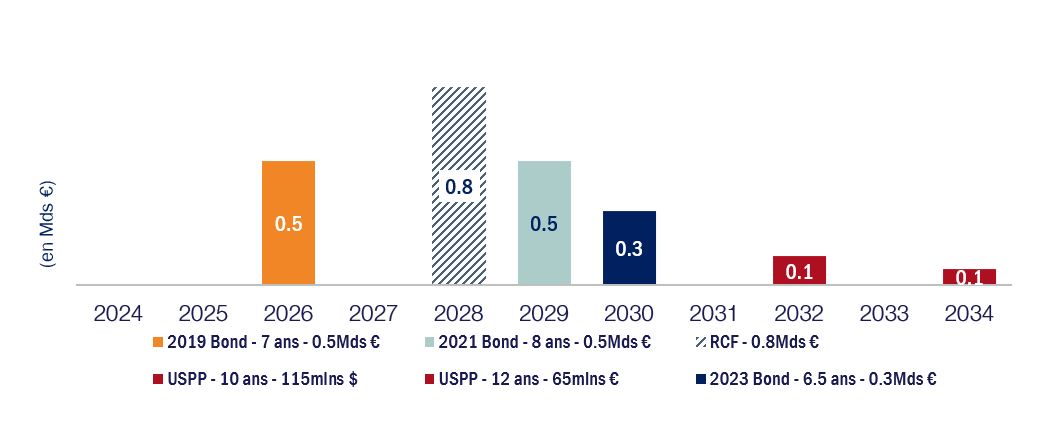

The 800 million euro syndicated revolving credit facility was signed on July 15, 2021 for a 5-year term. Following two maturity extensions, the credit will mature on July 13, 2028.

Bonds & Private Equity

On October 7, 2019, the Company announced that it had placed a second bond issue of 500 million euros, maturing in October 2026, with a rate of 2.25%. Settlement took place on October 14, 2019.

On March 24, 2021, the Company announced that it had placed a third bond issue of 500 million euros, its first durable bond, maturing in March 2029. Settlement took place on March 31, 2021. This issue of senior unsecured long bonds carries a fixed annual coupon of 1.625%, the lowest ever achieved by the Group. The proceeds of this financing are to be used in strict compliance with the Group's allocation framework (Sustainable Bond Framework) set up by the Group and approved by theagence ISS ESG

On February 11, 2022, the Company announced that it had successfully fixed the terms of an inaugural $180m private placement on the US Private Placement Market (USPP), structured in two tranches with maturities of 10 years ($115m) and 12 years ($65m), the longest ever achieved by the Group. The proceeds of this financing are to be used in strict compliance with the Group's allocation framework (Sustainable Bond Framework) put in place by the Group as part of its first sustainable bond issued in March 2021. This transaction reflects the confidence of US investors in the Group's credit quality and long-term growth strategy, and enables Tikehau Capital to diversify its sources of financing, while further affirming its ESG commitments. The transaction was priced on February 11, 2022, and closed on March 31, 2022.

On September 8, 2023, the Company announced that it had placed a 4ème 300 million bond issue with a fixed annual coupon of 6.625% maturing in March 2030 on the European public market. This is the third durable instrument issued, following the inaugural durable bond of March 2021 and the private placement on the US market of March 2022. The proceeds of this financing are governed by the Allocation Rules (Sustainable Bond Framework) set up by the Group and approved by theagence ISS ESG.

Amortization profileent - plan amortization(1)

(1)To September 14th2023

- 100% de debts arenon garanties

- Diversified sources of financing (balanced between bonds and bank debt)

- Limited exposure au interest-rate risk (with over 65% of gross debt at fixed rates)

Bond issues

ESG

The inaugural Sustainability Bond enables us to target impact investments on 4 priority themes for us: climate change, innovation, social inclusion and health. This fundraising is a strong signal of support for the investment teams already involved in impact investing.

- Laure Villepelet, CSR/ESG Manager

Tikehau Capital Sustainable Framework - 2023 bond issue

Tikehau Capital Sustainable Framework – 2021 Bond Issue & 2022 USPP Issue

Sustainable Allocation Reporting